Ben Bernanke and Olivier Blanchard recently published “What caused the US pandemic-era inflation?” The paper creates a basic model for inflation that is fit to data, and then uses it to attempt to decompose what drove the post-pandemic inflation.

The paper argues that the bulk of the inflation spike was mainly the result of “shocks” — energy, food, and their proxy for “supply shocks.” Once the shocks subsided, inflation calmed down. The labour market heated up (as proxied by the ratio of job openings to the number of unemployed) which raised inflation somewhat, but is supposedly more persistent and thus allegedly needs to be addressed.

Model Structure

The model is linear, based on a few simple “subsystems.” Although I expect that the usual argument is that the model structure is neoclassical, the simplicity of the linear model means that you could end up with this structure from a number of theoretical starting points.

Important variables in the model (in logical order) include the following.

Long-term expected inflation is based on its own lagged values, plus current inflation (including lags). This is somewhat similar to adaptive expectations, although it is feeding back the inflation expectations series. They use the 10-year inflation expectations calculated by the Cleveland Fed, which I view as a somewhat problematic (discussed below).

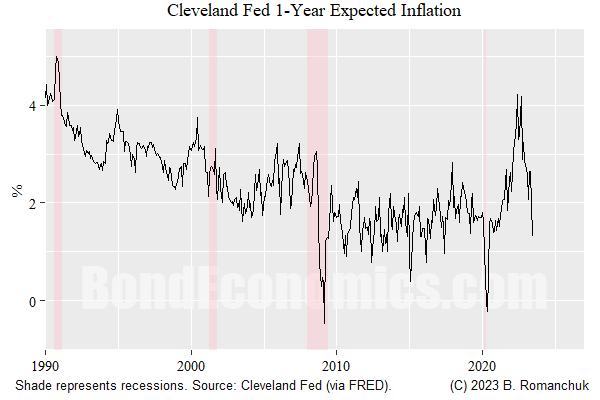

Short-term inflation expectations (1-year Cleveland Fed series) is modelled as a combination of lags of itself, long-term expectations (and lags), and spot inflation (and lags).

Wage growth is given (roughly) by the sum of expected inflation plus “aspirational real wage” plus a labour market tightness factor. (Note that the equation is in terms of the log wage, so the difference in the equation values correspond to growth rates.)

Prices are given by wages plus a “mark up factor.”

Inflation Expectations

Bernanke and Blanchard note that inflation expectations are anchored within the model. This is not surprising: in the main body of the article, they used the Cleveland Fed inflation expectations series that is the output of an affine term structure model (1-year series above). Mainstream economists love the outputs of those models: since they dump all the volatility of market breakeven inflation on conveniently unmeasurable “risk premia.” This allows central bankers to claim that they are doing a great job stabilising inflation expectations.

Looking at the above time series, it is somewhat hard to accept that 1-year inflation expectations peaked at just over 4% — when the latest annual CPI rate is still above that level.

My theoretical biases against affine term structure models aside, the slow-moving nature of “inflation expectations” under this definition dodges a theoretical bullet: what fundamental factors are supposed to drive inflation expectations? Saying that inflation is heavily driven by inflation expectations is perhaps plausible — but it converts the forecasting problem to forecasting inflation expectations instead of forecasting inflation — and that is not truly helpful. In 1994-2020, we could pretend that inflation expectations were anchored at 2%, but that anchoring broke down after the pandemic (for a short period, admittedly), even with the neutered Cleveland Fed series.

Post-Keynesians are unhappy with “inflation expectations,” but it is pretty clear that even in post-Keynesian theory prices are being set by firms as a markup over projected expenses. If “everyone” is expecting higher prices in the future, those projected costs are going up.

Wages and u/v

The interesting part of this paper is the emphasis on the ratio variable u/v: “Ratio of job vacancies to unemployment, from the BLS job openings and labor turnover survey (JOLTS) and the BLS Employment Report.” Since unemployment by itself as a measure of wage pressures has been an unmitigated failure (e.g., NAIRU), u/v seems to be the replacement. One of the problems is that job openings is a new time series, and it is unclear how clean it is. (E.g., firms apparently create openings that they do not intend to fill as a public relations exercise with their overworked employees or to simulate “growth.” Although changes in openings might convey useful short-term information, changes in behaviour may make the comparability over time questionable.)

Although the use of u/v as an indicator of labour market tightness is plausible, I am somewhat cautious of variables that have limited use in real time like Job Openings.

Other “Shocks”

It is not too controversial that we experienced large food and energy shocks, which are not going to be captured in domestic demand variables. Adding a proxy for supply chain shocks based on Google searches captures one-time supply chain disruptions, but it is effectively a dummy variable that is used to notch out some of the inflation spike.

The use of these variables has the effect of making the model look better, since it wipes out the transient model error during the inflation spike. A less charitable interpretation is that the model does a decent job of predicting inflation — except when it doesn’t.

From the perspective of profit-led inflation, that would be embedded in the markup factor, and would thus captured by the supply chain shock.

Conclusions?

One of the major issues I have with neoclassical macroeconomics is that there is often a wide gulf between the textual claims made in the article versus what the mathematical model actually demonstrates. In this case, the claims seem relatively modest — that one-time factors were the main contributor to the inflation spike. Just looking at the time history of inflation probably could tell us that, without any need for a mathematical model.

Where the claims are weaker are where they are forward looking, as well as the claims about the model.

Eliminating the inflation spike dynamics with “shocks” leaves a fairly placid “shock-free” inflation series to explain; it is unclear how much dynamics relying upon u/v are just a data mining exercise (pick a labour market series that looks like the wiggle in “shock-free” inflation in the last cycle).

Inflation expectations are supposed to be a forecast of inflation. (Whether this is true after the data has been mangled by being pushed through an affine term structure model is less clear.) Inflation is considered a lagging economic variable — why would we not expect forecasts to do a decent job of forecasting the underlying trend of inflation? Realised inflation being well behaved when forecasts of inflation are steady should not be a surprise. Moreover, it would be similarly unsurprising that inflation expectations would rise in an environment where realised inflation perks up.

"why would we not expect forecasts to do a decent job of forecasting the underlying trend of inflation" - all the usual "underlying inflation" indicators made a particularly poor job in the recent inflation being actually lagging indicators. Relying on them by central banks will induce excessively restrictive by maintaining restrictive conditions longer than when relying on headline.

ReplyDelete