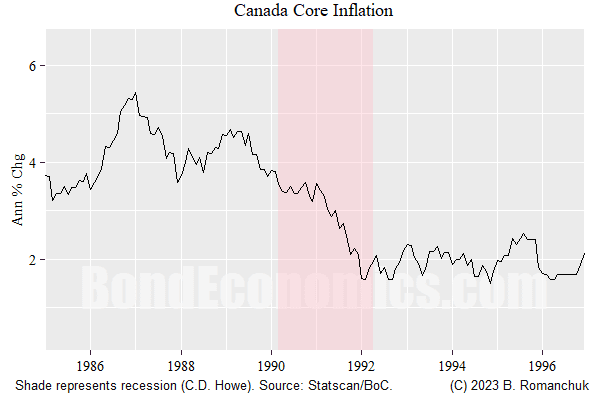

As initial background, Canadian inflation performance was poor in the 1970s and 1980s, somewhat more entrenched than in the United States. There was a crushing recession in the early 1990s — which I dodged by going into grad school. Canada moved to the inflation target/independent central bank model in 1992. After the recession, inflation remained subdued — although interest rates were volatile.

We then get to interest rates. The description provided by Omran & Zelmer is dramatic.

The backlash of the Mexico peso crisis [emphasis mine] raised concerns about Canada’s debt situation and created market pressures that were evident through higher short-term interest rates, which were only partially offset by a weaker Canadian dollar. These furthered worry about the fiscal balance and higher debt-servicing costs. The Bank’s initial hesitancy in raising its operating band for the overnight interest rate only added to investors’ uncertainty and diminished the credibility of the Bank. The resulting capital flight out of Canada sent real interest rates across all maturities soaring [emphasis mine] and further weakened the exchange rate.

Gosh. Soaring interest rates after the Mexican peso crisis (December 1994). Let’s look at the carnage.

The figure above shows the Bank Rate (policy rate) and the 5-year Government of Canada rate. (Wednesday figures provided by the Bank of Canada.) We see that the 5-year yield did take off — in early 1994. This was coincident with the very well known Treasury bear market of 1994. (Any time when I was in finance that I expressed a bullish view on bonds, I was always pointed to 1994.)

The bear market looks extremely vicious by 1995-2020 standards, but it can be interpreted as a retracement to early 1990s levels. Although the levels were stupidly high in retrospect, they seemed entirely reasonable to the bond investors at the time, whose valuation metrics were decidedly backwards looking,

What about the peso crisis? Well, the devaluation was in December 1994 (red vertical line). The 5-year yield had essentially peaked by that time. The Bank of Canada was hiking rapidly near the end of the year, but the bulk of the rise in the 5-year yield happened by mid-year.

In a real fiscal crisis where there was an actual chance of default, it should be possible to spot the crisis on a chart.

External Funding Crisis

An alleged dependency upon foreign creditors and a currency crisis seems to be the larger fear. Once again, I could not pin down anything specific, but I have grabbed what appear to me important statements.

Large international holdings of Canadian debt, if nothing else, made Canada more susceptible to disturbances such as the 1994 Mexican peso crisis, which made investors wary of governments with large deficits and increased their fears that Canada was fiscally unsustainable.

At the same time, the Canadian dollar was depreciating rapidly, and although this led to an increase in net exports, it also fuelled higher import prices. As this depreciation accompanied investors’ demand for higher risk premiums, the short-run trade-off between output and inflation became more severe, limiting the Bank of Canada’s ability to support either.

And this is an important assertion.

The sharp downward pressure on the Canadian dollar, coupled with invidious comparisons to Mexico and the growing threat of an investor run, eventually forced [emphasis mine] the Canadian government to take action to put its finances on a more sustainable path.

The “invidious comparisons to Mexico” possibly refers to the famous (in Canada) Wall Street Journal editorial headline that referred to the “Canadian Peso.” In order to understand the calibre of the Canadian economic Establishment, this headline caused considerable panic. The important issue is: did anything dramatic happen to force anything?

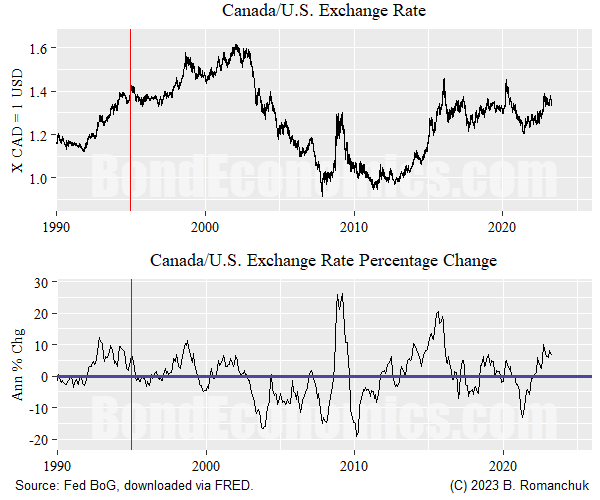

Let us look at a chart of Canadian dollar in terms of the U.S. dollar (Canada’s dominant trade partner). The top panel shows the usual quote convention — how many Canadian dollars (CAD) to buy 1 U.S. dollar (USD)? (The interpretation of this is that the line going up is a weaker Canadian dollar.) Although CAD was weakening in that era, it was a fairly steady decline — which is a typical pattern for currencies. In later years, we see larger — and more rapid — movements in both directions.

The bottom panel shows the annual percentage change in the Canadian dollar. Although “going up” means “weakening” and thus the sign convention perhaps not obvious, you can think of it as being the “inflation rate” associated with the currency. (It is very useful to compare this percentage change chart to an inflation chart, since the two variables are supposed to move together if there is imported inflation. When we compare the early 1990s experience to later CAD weakness (such as in the Financial Crisis and the mid-2010s), it is best described as a nothingburger. Furthermore, the weakness happened mainly before the peso crisis proper (red line - December 1994).

There is no reason to argue that Canadian dollar weakness should have “forced” anything.

Other “Risk Premia”?

The authors refer to other “risk premia” without specifying what they were. If they were important, it would be useful to actually say what they were. I don’t have access to much in the way of Canadian non-rates financial market data, so I am not in a great position to comment on this.

Policymaker Panic

Although I cannot see anything interesting in market data, it is clear that policymakers panicked. The question is: how legitimate was the panic? Saying that the “markets are forcing us to cut spending!” is a rather convenient line for unelected bureaucrats with an ideological bias towards tighter fiscal policy.

Fiscal Tightening — Necessary to Keep Inflation in Line?

It should be noted that Canadian inflation never really took off once the recovery was under way. Market participants presumably thought that it would, hence the rapid steepening of the curve. The message of the Omran & Zelmer paper was that the government was forced to cut spending to keep inflation under control.

However, that argument is hardly contradictory to MMT, and actually shoots their “independent central banks are valuable” theory in the foot. An inflation target and an independent central bank was not enough to get “inflation credibility” with the markets (whatever that is worth) — fiscal policy also had to be tightened as well.

I am not interested in re-litigating the 1990s. The fiscal tightening of the mid-1990s almost certainly helped kill inflation variability in Canada (until 2020). Whether or not this was a good idea, or whether other policies could have achieved the same outcome are counterfactuals that I cannot hope to answer.

No Default = MMT Not Wrong

The key take away from this episode is that Canada was not forced to default on its debt by bond and/or currency vigilantes. Market pricing in fact was nowhere near suggesting such an outcome. Although policymakers panicked — they voluntarily panicked. Meanwhile, blaming the markets for “forcing” spending cuts is exactly what you would expect spineless policymakers with a loose attachment to the truth to do.

Mainstream economists are supposed to be fans of quantitative science. You cannot count a “no default” event as a “default.”

Concluding Remarks

Although this episode is popular to point to by the Canadian Establishment to justify austerity, it is nearly impossible to find a description that is not purely a qualitative picture of the feelings of Canadian economists and policymakers. The problem is that economists tend to greatly overrate their grasp of what is happening in markets. All I can really say for sure is that Canadian policymakers panicked in 1994, and that panic was used as an excuse to cut spending.

Tighter fiscal policy is supposed to lead to lower inflation according to MMT, and so this episode is not really contradicting MMT. Voluntarily cutting spending because of ideological sympathies is not the same thing as being forced to cut spending because of bond/currency vigilantes. Furthermore, pointing out that governments had to slash spending to get inflation under control is not a selling point for the importance of the central bank for inflation control.

No comments:

Post a Comment

Note: Posts are manually moderated, with a varying delay. Some disappear.

The comment section here is largely dead. My Substack or Twitter are better places to have a conversation.

Given that this is largely a backup way to reach me, I am going to reject posts that annoy me. Please post lengthy essays elsewhere.