The interesting thing about the U.S. dollar rates markets is how the market shrugged the news off. Since some hikes were already priced in, this technically should not be a surprise. However, the terminal Fed Funds rate does appear low — but this perhaps fits the low rate regime seen in the last cycle.

Market pricing seems to fit a consensus scenario of inflation remaining elevated enough in the coming months to force some initial hikes. Then base effects will take their toll on the inflation rate, and so it will be harder to engineer an inflation panic, allowing the central bank to drop back to wait and see mode.

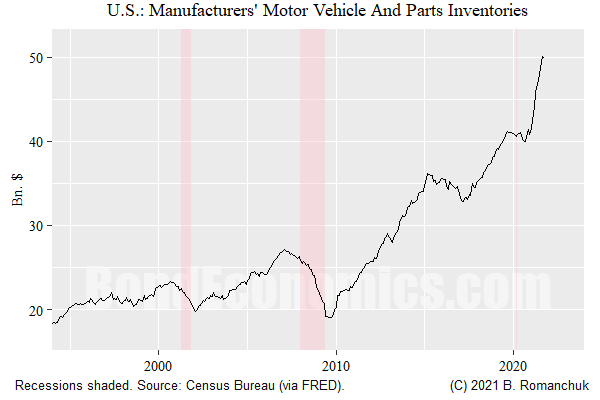

One of the major areas of inflationary problems in the United States has been in autos. I believe that the chart above captures one of the main fundamentals for the auto market: chip shortages are the key. Inventories are piling up at manufacturers, just waiting for the chips to be plugged in. Once the seasonal surge in consumer spending is past, we will be able to see whether disrupted supply chains ease.

Outside the United States, the natural gas situation in Europe is perhaps the most worrying area. Its importance in industrial processes could easily lead to knock on effects. My guess is that inflation stories might diverge more on a regional basis than has been the case in the past year.

The other major development is the stalling out of Biden’s economic agenda. This should take the edge off of aggregate demand. This is almost certainly more important than a few token rate hikes — but commentators are likely to claim that any easing of inflation was entirely the result of the Fed’s change of stance.

The debate about the effect of any rate hikes is likely to be fairly intense. From a rates market perspective, the debate matters in that if the consensus believes that 75-100 basis points is somehow enough to take the edge off of inflation, the terminal policy rate need not be much higher. The issue is how such a stance could be squared with a belief that real interest rates matter (as opposed to nominal), and real rates are still likely to be quite negative until late 2022.

No comments:

Post a Comment

Note: Posts are manually moderated, with a varying delay. Some disappear.

The comment section here is largely dead. My Substack or Twitter are better places to have a conversation.

Given that this is largely a backup way to reach me, I am going to reject posts that annoy me. Please post lengthy essays elsewhere.