Partisan Bickering

I will not pretend that I am neutral on political economic debates -- I doubt that I will be invited to speak at a libertarian convention any time soon. However, I try to avoid telling people how they should vote in their elections.However, I need to note that being "pro-growth" has become a motherhood issue for Republicans, which led Larry Summers to plead to progressives to become "pro-growth." Both he and John Cochrane argue that a tight labour market is the best social programme (which is what Minsky was saying all along). However, John Cochrane lays it on thick at the end of his article:

If Larry can persuade Mrs. Clinton and the "progressives" in the Democratic Party to focus on growth, to state goals for growth, and to hold themselves accountable for growth, then we can have an honest and very productive conversation about what's stopping growth and what steps can further it.Accountability? I have my doubts that the Republican party really wants that. As Gerard MacDonell notes at the end of this article, the United States lost private sector jobs during the term of the last Republican President. His harsh assessment:

But a more sensible inference here is that you can just save yourself some time when the right starts lecturing you about a “growth agenda.” There is no evidence that the GOP has ever implemented an actual growth agenda, at least as measured by — you know — EVIDENCE of effects on the economy.Partisan wrangling aside, should we care about growth, for the sake of growth, and is now the time for a big fiscal boost to pursue growth?

Resource Limits To Growth

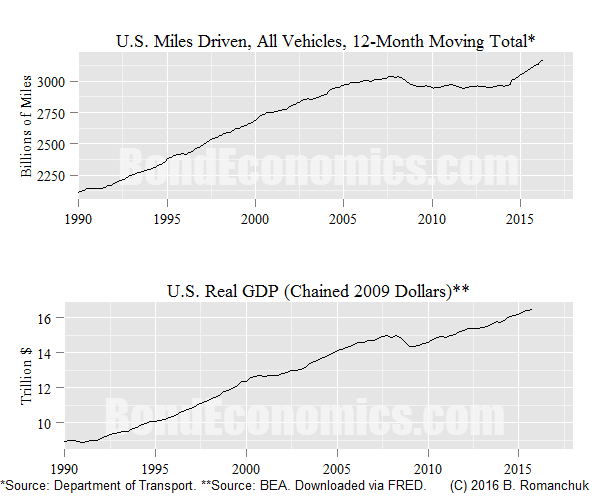

One reason that progressives are "anti-growth" is the result of environmental concerns. Although I am in the "Peak Oil" camp, I dislike arguments that say that we cannot have "infinite growth on a finite planet." (Please see "Sustained Growth on a Finite Planet" for my views on the topic.) It is possible for measured GDP to grow, even though real resource usage is flat. As a miniature example, note how U.S. miles driven was flat for a few years after 2010, even though real GDP was chugging along.

Of course, the fact that the economy can grow without hitting resource limits is possible, does not mean that it will happen. There is no reason to believe that the U.S. economy is switching to a less oil-intensive growth path, and renewed strong growth would most likely cause energy consumption to pick up. One may note that miles driven has finally responded to steady GDP growth in the last few years. Export-dependent developing countries would perk up in response to U.S. growth, and an oil price spike would be waiting in the wings.

Unless the economy is restructured to be less vulnerable to energy price spikes, planning on sustained high growth rates may be a fantasy. (In a slow growth environment, the economy can more easily adapt to resource constraints.)

Infrastructure Stimulus Now?

One of the ideas that Larry Summers and others (such as the

Although I believe that it will take years for the U.S. labour market to overheat, that is a function of the current slow growth environment. Job growth is only slightly faster than population growth. Furthermore, I believe that the headline (U-3) unemployment rate overstates the reduction in labour market slack.

However, the level of slack is much reduced, relative to the situation at the start of the decade. We can use the U-6 unemployment rate as a proxy for underemployment in the economy. (The U-6 unemployment rate includes more people who are underemployed.) The latest reading of the U-6 rate is 9.7%, which is about 3% above the minimum reached during the relatively tight labour markets during the tech bubble. Under the current economic structure, the labour market was overheating. (One could imagine labour market reforms -- such as a Job Guarantee -- allowing for a much lower level of underemployment. That is outside the scope of this article.)

This appears to allow for a burst of strong job growth. Unfortunately, U.S. labour market is obviously segmented. The "high skill" segments are doing relatively well (at least when compared to "low skill" segments). The chart below shows the unemployment rate for Americans with at least a College degree. At 2.5%, it is only a percent above where it was during the tech boom. (Admittedly, the tightness of this segment of the labour market is overstated by the reality that employers are demanding college degrees for jobs that obviously do not require them, such as being fry cooks.)

Non-targeted "demand management" (such as infrastructure spending) is probably going to require creating jobs for college-educated workers. (You need an engineering degree to sign off on plans, for example.) It is a safe bet that the job market for college graduates would become extremely tight before the U-6 unemployment rate even begins to close on its historical lows. This would cause inflationary pressures for businesses that rely on college-educated workers.

The inflationary consequences of non-targeted demand management was why Minsky was skeptical about using the policies in the 1960s and 1970s, and I doubt that conditions are much different at this point in the cycle. (One could argue that there was a window of opportunity in 2010, but that window was closed by the slow growth that has occurred since then.)

(Readers could reasonably ask -- what is so bad about inflation? Is unemployment not a greater social ill than a bit of inflation? Although that is an interesting question, I will stick with the consensus view that inflation will remain contained. An independent Fed will do its best to end the cycle if inflation heats up, cancelling out the fiscal thrust. Furthermore, inflation is politically unpopular.)

Targeted Employment Growth

The sensible objective of policy is targeted employment growth; this would allow the U-6 rate to be reduced, while not causing the stronger segments of the labour market to overheat. A Job Guarantee would be the most effective policy towards that end, but I imagine that there are partial steps that could be taken in that direction. In any event, we would need to model the microeconomic impact of the policies, and not rely on aggregate demand management.It is likely that this would improve the bargaining position of labour, and achieve other social policies. Furthermore, it would probably increase growth rates. However, this effect on growth is best viewed as accidental. The focus should be on eliminating imbalances within the economy, and let the growth rate be sorted out on its own.

Politicians of all stripes find it necessary to argue that whatever policy they endorse will increase growth; to do otherwise is probably political suicide. We need to set these concerns aside and focus on the real effects of policies, and not worry about the nebulous effects on growth.

(c) Brian Romanchuk 2016

Bernie Sanders not Barry. I'm gonna be right for once in a comment :)

ReplyDeleteOops. I guess I had football on my mind...

DeleteGood post.

ReplyDeleteOne other reason to be against "growth" is that higher GDP does not increase people's wellbeing. In my view this is clearly true for countries with per-capita GDP above $15,000-20,000 or so. This is, obviously, a minority view. For most economists the case for growth is so obvious it doesn't even need stating -- having more stuff makes people happier.

But even though I don't believe that I still think it's worth defending the idea that there is more space for expansionary policy to raise GDP. For three reasons:

First, I think Summers and Cochrane are right (!) about the importance of tight labor markets to raise wages, flatten the income distribution and increase the social power of working people

more broadly. I don't think you would have had the mass social movements of the 1960s and 70s (even on such apparently non-economic ones as feminism and gay rights) if there hadn't been a long period of very tight labor markets. The threat of unemployment maintains the power of the boss in the workplace, and that reinforces all kinds of other hierarchies as well.

Corollary to this, I'm not convinced that the labor market is as segmented as you suggest here. I think your suggestion that people with more credentials get to the front of the queue for the same jobs is more accurate in most cases than the idea that they are competing for separate jobs. It seems to me the historical evidence is strong that when aggregate unemployment falls there are disproportionate gains for those at the bottom.

Second, I think the idea of a hard ceiling to potential output is an important part of the logic of scrcity that constrains policy in all kinds of harmful ways. Yes, infrastructure spending, and sometimes also increased social spending, even a basic income, can be presented as measures to boost demand and output. But you can also look at it the other way -- these are desirable on the merits, and the claim that they will boost output is just a way of defusing arguments that we "can't afford" them. To me, the policy importance of saying we are far from any real supply constraint isn't that higher output is desirable in itself (apart from its labor-market effects) but that it strengthens the argument for public spending I support for its own sake.

Third, on a more academic level, I think the idea of a fixed exogenous potential output is one of the most important patches (along with the "natural rate of interest") covering up the disconnect between the world of "real exchange" of economic theory and the actual monetary production economy we live in. Assuming that the long-run path of output is fixed by real supply-side factors is a way of quarantining monetary and demand factors to the short run. So the more space we open up for demand-side effects, the more space we have to analyze the economy as a system of money claims and payments and coordination problems rather than the efficient allocation of scare resources.

I do not hold a very strong "anti-growth" view; maybe I am feeling mellow about the current growth outlook. There's certainly room for some strong growth, but not sustained "above trend" growth for an eight-year Presidential term. (Unless there are structural changes to the economy that neither presidential candidate is calling for.)

DeleteI do not see a long-term hard ceiling to growth, but in the short-term, you do see somewhat predictable capacity constraints. If the structure of the economy shifted to reduce underemployment, we should be able to push down unemployment rates below previous "benchmarks" without moving inflation a lot. (This was an area where I had simplified my remarks, but I perhaps should have added some nuances.)

Whether the wage/profit shares can be rebalanced without wage inflation ending up driving consumer price inflation seems to be an open question. A slow secular shift reversing the previous slow secular shift is plausible; but it seems hard to see a rapid wage rise at the same time as a rapid drop in profits.

This comment has been removed by a blog administrator.

ReplyDeleteBy "pro-growth", do you mean of the supply side or the demand side?

ReplyDeleteSince supply is supposed to equal demand, should be the same thing...

DeleteFrom a policy standpoint, governments need to address the cycle via the aggregate demand side. The supply side is generally left to take care of itself. The government can attempt to address supply side concerns, but that is largely a microeconomic story. I do not have any particular axes to grind with regards to such reforms.

Huh?

DeleteI have seen where quantity supplied can be greater than, equal to, or less than quantity demanded.

Quantity sold does equal quantity bought.

At a market clearing price, supply equals demand. If the price is not at that magical point, yes, supply and demand would not be equal. But if we start moving away from an assumed equilibrium state, not sure how meaningful "supply" and "demand" are.

Delete