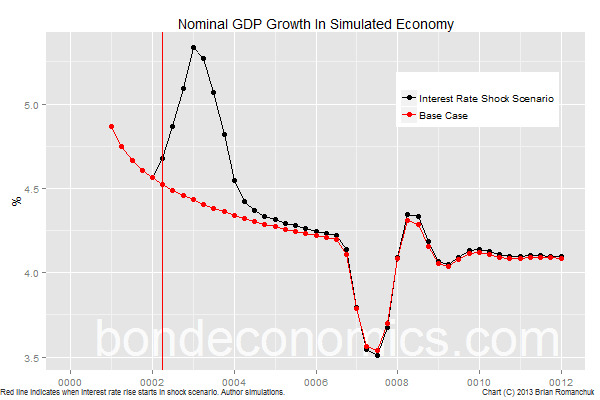

This article is going to be the first of a series which discusses the trade-offs involved in fiscal policy. To illustrate my points, I run simulations on a basic Stock-Flow Consistent (SFC) model, such as the simulation data shown above (see this entry to see my other discussions of SFC models). This model is a teaching tool to illustrate long-term fiscal dynamics, and there has been no attempt made to fit it to real-world economic data. Business cycle dynamics are also deliberately suppressed; I explain why further below.

The chart above shows one of the simpler cases to study:

what happens if governmental interest payments rise, and all else is held

equal? The standard worry is that interest payments would “crowd out” other desired

spending. What we see in this model framework is that interest payments crowd

out welfare payments, and it does this by lowering the unemployment rate. This

would generally be viewed as a desirable outcome.

Outlining The Model

(Note: I wrote an earlier article, “Why Interest Payments Do Not Pose Fiscal Risk”, which gives a verbal outline of why this dynamic occurs.

I hope that the use of the simulation should make the explanation easier to follow.)

My model is a variation of the models discussed in the

textbook “Monetary Economics” by Wynne Godley and Marc Lavoie. I have built my

model to represent the trade-offs involved in fiscal policy for a modern

welfare state, and is less sophisticated than the more advanced models in that

text for modelling business cycle dynamics. This was a deliberate choice: if

the model economy continuously generates strong business cycles, the outcome of

simulations will mainly depend on whether recessions are avoided or not.

Instead, my model has fairly damped cyclical dynamics, and slowly moves towards

steady-state outcomes.

This model does not follow analytic conventions used in

modern Dynamic Stochastic General Equilibrium (DSGE) models, which are the

modern mainstream economic analysis framework of choice. I do not view this as

a problem, as I believe that DSGE models have been constructed to model

monetary policy almost exclusively, and are not useful for analysing long-run

fiscal dynamics. I will discuss this claim in follow-up articles; it would be

too much of distraction to attempt to cover that topic right now.

How the model largely abolishes the business cycle is that

fixed investment is not considered – firm output is determined solely by the

number of employed workers. There is investment in inventories, and there are

some cyclical dynamics associated with inventory adjustments. (In the chart

above, the rise in the unemployment rate around year “0007” was caused by a

small overshoot in inventories before the economy reaches the steady state.)

Since there is no fixed investment, there was no need to

model private sector financial assets (other than the non-traded equity of the

business sector). The only financial asset is floating-rate government debt,

which is also used as money (it trades at par). I do not divide government

liabilities between non-interest paying money and interest-paying debt, as that

distinction is a cosmetic detail in macro models at this level of abstraction.

Fiscal policy within the model is characterised by the

following parameters.

- The government pays interest on its debt. Under the base case scenario, the interest rate is 3%, which rises to 5% in the “interest rate shock” scenario. In order to be symmetric with the weaknesses of DSGE models, which ignore fiscal policy in order to analyse monetary policy, this model ignores monetary policy (other than the interest income channel) in order to analyse fiscal policy.

- There is a flat income tax rate of 25% on all income received by the household sector (both wage and dividend income). The business sector is not taxed, which is becoming a good approximation of the current situation in the developed countries.

- The government employs 25% of the working population at the going wage rate. These employees presumably collect taxes, defend against other simulated economies, and educate the virtual workforce. The output of these employees is not sold. For simplicity, the government does not purchase goods from the business sector.

- The unemployed receive welfare payments which is set at 60% of the wage rate. (Note: I do want to drag in demographics, so the entire population is assumed to be either working or on welfare.)

I would like to underline that fiscal policy is 100%

passive; there is no attempt to change spending or taxes in response to the

business cycle. However, taxes and welfare spending will act to stabilise the business cycle. (See my article on the debt limit to see a simulation of what happens if these welfare state programmes are deactivated.)

Other parameters:

- The workforce grows at 0.5% per quarter; if the unemployment rate is unchanged, this implies that real output rises at just over 2% per year.

- There is a steady inflation rate of 0.5% per quarter. I assume that the central bank is so credible that there are no deviations from the target inflation rate just over 2%.

- The implication of the two previous points is that nominal GDP grows at 4.07% per year when at steady state. This is what we see in the chart below. Note that the model economy was recovering from a recession at the beginning of the simulation, and so it starts off with a higher growth rate. The shock scenario shows an acceleration starting in year “0002” due rising interest income feeding through the interest rate channel. The recession around year “0007” is due to an inventory overshoot in the business sector as it makes the transition from faster growth to steady state.

- The household sector follows “stock-flow norms”: it essentially attempts to keep the ratio of its spending to its income near some target level. This is achieved via it spending fixed proportions out of income and its financial assets (government debt holdings).

- The business sector also follows a stock-flow norm: it attempts to keep the volume of inventory at the same level as one quarter’s sales. (It uses adaptive expectations to estimate sales volumes.) Since there is no fixed investment, profits are mainly distributed in the form of dividends. (However, I discovered that inflation accounting is a bit of a nightmare, and I will have to re-read those sections in the text by Godley and Lavoie.)

Since the economy is growing at (roughly) 4% per year, if the

household sector is to keep its financial asset holdings near a target ratio to

its nominal income, the stock of government debt has to be growing at 4% per

year. This implies that the government must run deficits, and in the top panel

of the chart below, we see that the two scenarios have the deficits roughly

converging to the same level. (There is a small difference, as higher interest

payments raises household incomes in the shock scenario.) This illustrates the

important point which does not appear to be widely understood – an economy growing in

nominal terms needs to run fiscal deficits in order to stabilise the ratio of

government-guaranteed financial assets (including money) to incomes.

Since the government deficits are essentially the same (as a

percentage of GDP) in the two cases, and all other spending and tax parameters

also match, the only way that interest payments can rise is if welfare payments

fall. As the bottom panel in the chart above shows, this is what happens. Since

welfare payments per recipient was fixed, the unemployment rate must be lower

in the steady state (as was shown in the first chart at the top of this post).

Interpreting These Results

The standard working assumption in the analysis of fiscal policy is that the government wants to keep its fiscal parameters fixed. The idea is that the chosen policy mix has to be shown to be “sustainable”. (Of course, in practice, fiscal policy settings are juggled continuously as the result of the political process.)

In the context of this model, that standard is met – no fiscal

parameters were changed, even though interest payments rose. Welfare spending

fell, because people left welfare to enter the workforce. (A policymaker would

have to be somewhat sociopathic to demand the level of unemployment does not

fall so that welfare payments are not reduced.) There appears to be a free

lunch – crank up interest spending in order to drive down unemployment.

However, this is not really a free lunch – fiscal policy

settings are too tight in the base case scenario, and the same reduction of

unemployment could have been achieved via cutting taxes. (For those of you who

follow Modern Monetary Theory, Warren Mosler pointed out that tax cuts would be

preferable to interest income to stimulate the economy.)

The limit to loosening fiscal settings would be the

achievement of “full employment”. Inflation generated by excessive demand is

the real constraint on government spending. (The view that inflation is the real limitation on government spending was first advanced by Abba Lerner, who called this approach "functional finance". This recent post by Bill Mitchell has a small discussion of functional finance.) This model is not set up to analyse the details of that trade-off; it depends upon how sensitive inflation is to lower unemployment rates. That said, interest rates are higher in the “shock”

scenario, which would theoretically act to offset the inflationary impact of a

lower unemployment.

In any event, rising interest payments by the government is unlikely to push economies to full capacity in the developed economies in the real world. Unless the

bond markets get Volcker-ed, interest payments are too small to make a major dent in the spare capacity that opened up during the last recession. Additionally, interest payments are

mainly received by entities that have a low propensity to spend out of their

incomes (e.g., the wealthy, foreign central banks and pension funds), and so the impact of increased interest payments will probably take longer to show up than is the case in this model.

This comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete